In this article, Collegiate has teamed up with Dan Kelly, MD of specialist professional indemnity insurance broker Onyx, to provide some thoughts on the FCA’s impending review on “retirement income advice”. We will talk through what the review is and what we can expect from the FCA, and how this may impact upon the FOS and the wider market. We will also look back at the FCA’s painfully drawn-out review of the British Steel Pension Scheme (BSPS) and their current review into equity release and mortgage products to try and predict what is coming and how firms can best prepare.

The FCA announced in January 2023 that they would be restarting their review into the suitability of advice and services provided to individuals, with a focus on pensions and retirement income advice. This was originally announced and details published in January 2020 but put on hold due to Covid. Now, fresh from what the FCA will presumably see as the success of the BSPS review, they are ready to move on, with pensions and retirement advice firmly in their sights.

As with other past business reviews, the industry can expect the FCA to reach out to a number of firms to request their new business registers, policies, procedures and a selection of client files so that they can assess the suitability of the advice. This can lead to remedial action against a firm or even at an industry-wide level.

While the FCA has not confirmed what the focus of review will be, this is widely expected to be on charges and “value for money” for the client, although presumably still linked to suitability of the advice as a whole.

Their previous review was paused so that they could focus on more pressing areas, but FCA data from last year might give an indication of what they are going to focus on.

In October 2022, the FCA published their retirement income market data for 2021 which highlighted that[1]:

· The number of clients taking drawdown saw an increase of 24% from 165,988 in 2020/21 to 205,641 in 2021/22.

· 40% of regular withdrawals were withdrawn at an annual rate of over 8% of the pot value (43% in 2020/21).

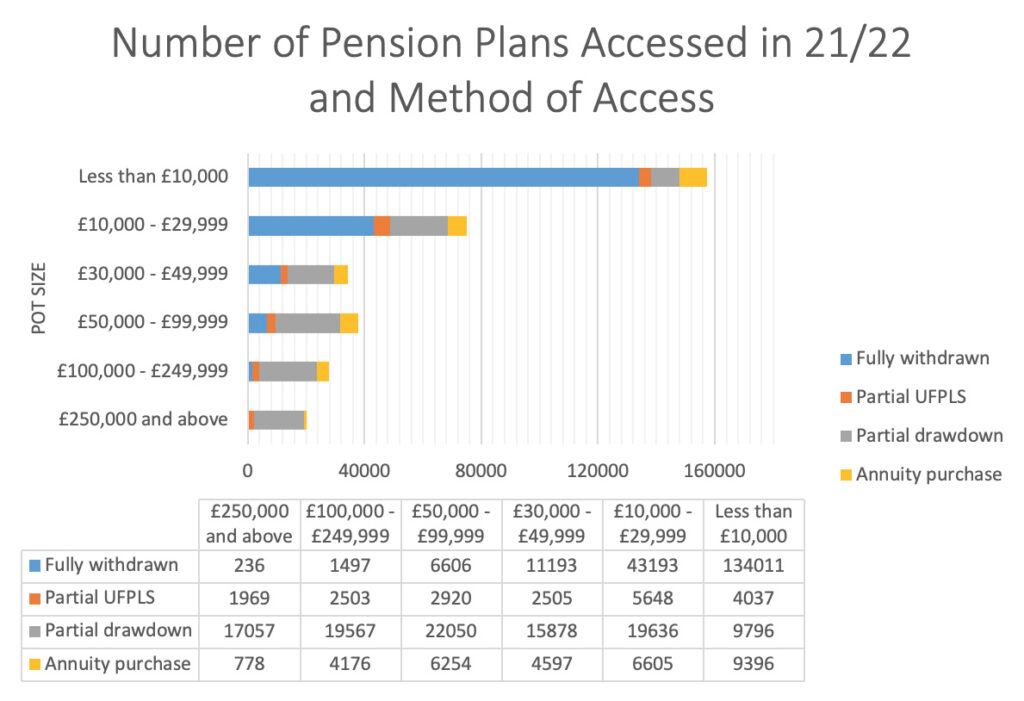

· As shown by the graphic below, even on pension pots between £30-50,000, far more people are opting for ‘flexible’ retirement solutions than traditional annuities.[2]

[1] https://www.fca.org.uk/data/retirement-income-market-data-2021-22

[2] https://www.fca.org.uk/data/retirement-income-market-data-2021-22

This data suggests that a large number of people are taking regular withdrawals from their pensions and that most people are steering clear of the traditional safe annuity.

On top of this we know that the Regulator’s 2020 review of RDR found that over 90% of new clients are placed in “ongoing advice” charging structures and the FCA is keen to ensure that clients are obtaining value for money for these fees.

All of this data combined to create an area of interest for the FCA, with the potential for consumer detriment.

This will also be the first review after the FCA’s new Consumer Duty comes into force, which will be another unknown variable and may mean that the FCA expects a firm to drill down on any potential failings identified and be more proactive than they would have been previously.

1 – The FCA’s findings from 2017 should not be relied upon

The FCA’s initial review into this subject in 2017 was, on the whole, very positive. It suggested that over 90% of the advice reviewed was suitable and they seemed broadly comfortable with the position.

However, the 2017 findings were based mainly on data from 2015-2016, which was only a couple of years after the implementation of the Pension Freedoms. As we can see from the helpful table provided by the FCA in their 2021/2 data review, a very large number of people are now opting for more flexible retirement options. With flexibility comes risk, and one thing everyone should have learnt from the BSPS situation is that the FCA does not believe that most people should take risks with their retirement planning.

2 – The FCA have always been playing catch up with the “Pension Freedoms”

The Pension Freedoms were a political idea, conceived by George Osbourne and intended to revolutionise the pensions landscape. The reforms were rushed through, giving the FCA very little time to implement any consumer protection legislation or guidance about what “suitable” advice looked like in their eyes.

This is evidenced by comments made by the then head of the FCA, Charles Randell during a speech in May 2022 at Queen Mary University. During this talk he made it clear that “the policies and procedures necessary to mitigate the potential harm to consumers from the pension freedoms were still being retrofitted six years later.” Mr Randell has also been unequivocal on the fact that the pension freedoms’ core policies and their implementation methods were found wanting.[1]

This leads to a situation where individual advisers are left to use their best judgement about what will be suitable for each client. While this works fine in the real world, as we have seen with the BSPS review, this is very difficult to judge, from a distance, during a past business review.

It is well known that the FCA does not think most people can be trusted to make their own financial decisions or strive for an ‘above ordinary’ return by taking some risk or paying for more tailored advice. It is also clear from ‘British Steel’ that the FCA was not given sufficient time to put in place any proper rules and guidelines for what they would consider ‘suitable’ or not. That said, the fact that the FCA’s regulatory approach is based on vague principles and duties, means that financial advisory businesses will always face a risk in this regard.

3 – A focus on “value for money” in advice

Since RDR the FCA has had a focus on clients being able to easily understand what advisers are charging them and what they should expect to receive in return. It is likely that the FCA will hone in on what fees are being taken and what exactly the client is receiving for these. In view of the importance of the ongoing portfolio management for people who steer clear of traditional annuities and keep more of their money in the markets, we expect the FCA to be very interested in ongoing charges.

We can also gain some insight as to what the FCA’s focus might be by considering the FCA’s other ongoing review into equity release and second charge mortgages. We have seen them single out and focus on firms providing second charge mortgage products, which by their very nature require a lot more bespoke work by advisers and necessitate higher charges. The FCA has been heavily scrutinising such work, despite not appearing to understand its specialised nature and it would appear likely that firms that offer a more tailored pension offering may be subject to the same interest.

4 – A retrospective re-writing of the rulebook

The rising investment markets over the last 10 years has meant that complaints about flexible retirement options like income drawdown have become fleetingly rare. However, if we cast our mind back to 2009-2013, firms and their insurers were dealing with a large number of complaints from people who had opted for a drawdown option over an annuity in the 2000s. The combined effects of a recession and individuals taking large drawdowns decimated people’s pension funds and the FOS was quick suggest that people with pots of around £200,000 or less should not be advised to utilise more flexible retirement options.

The FCA’s approach to regulation, which is based on generalised and abstract principles, leaves firms at the mercy of the FCA and FOS when it comes to them re-writing acceptable standards.

While the currently buoyant markets mean that a huge raft of problems of this nature would appear unlikely, if the markets do turn in the next year, the situation could get ugly, especially if one thinks about how many individuals would have been tempted by drawdown when viewed next to the miserly annuity rates that have been on offer for the last decade.

5 – Increased attention from Claims Management Companies

As we have seen with every FCA review or general “problem area”, the growth of claims management companies (CMCs) in recent years means that any general statements or vague standards suggested by the FCA are likely to be pounced upon by an army of hungry CMCs.

The majority of these firms will usually be working on a CFA (“no win no fee”) and so while they cannot claim any costs for dealing with a matter at FOS, they will likely be taking a percentage of any redress paid. As such, they will be keen to see the FCA’s and FOS’s approach to claims relating to this review, especially with the new higher FOS limits for advice provided after April 2019.

1 – Maintain strong Client Relationships

With any luck, this FCA review will be quick and painless, finding that the financial advisory profession have, for the last seven years, been complying with whatever standards that the FCA now decide was correct.

However, what we have learnt from the BSPS fiasco and previous “past business reviews” that turn into mass client-contact exercises is that maintaining a strong relationship with your client is key. A client that has a strong sense of trust in relation to their adviser and feels able to pick up the phone is much more likely to engage positively with any ‘client contact’ process. In addition, a personal relationship is also helpful in dissuading those less scrupulous clients from ‘opting in’ to any review just in the hope of some “free money”.

2 – Ensure that advice files are as “personal” as possible

One key lesson we have learnt from the British Steel situation is that both the FOS and FCA are far more willing to believe contemporaneous evidence (including suitability reports) if these reports include sections written in the clients own words.

We dealt with one firm that had inserted blank ‘text boxes’ within their suitability reports and asked the clients to hand-write their understanding of the risks and why they wanted to transfer their pension. Despite the clients in question having no special need or driver to transfer, these hand-written notes were enough to mean that the FOS rejected every single British Steel complaint for the firm in question.

Similarly, one positive of Covid we have seen is that virtual client meetings have often been recorded. We have seen decisions where, in line with the above, the FOS has rejected claims where we would often expect to see an uphold. While a recording will always be the best contemporaneous evidence of a meeting, of course any recording needs the client’s express consent and is perhaps best suited to virtual meetings only.

It may also be beneficial to firms’ advisory processes to start from the point of view that the FCA is likely to still believe that an annuity should be the default retirement option for most clients, especially those with under £200,000 in retirement savings. While it is perfectly possible to recommend alternatives under this savings threshold, the file needs to be detailed and well documented including evidencing that the various options available were costed.

3 – Evidence the benefits of any ongoing fees

What we have seen from the ongoing FCA review into equity release and mortgage products is that the FCA is sceptical of high charges and does not believe the majority of clients actually benefit from the idea of paying more for better, more regular advice.

Therefore, regular review meetings need to be evidenced and well documented, a calendar note showing that the meeting took place is not going to be sufficient. In addition, the FCA is likely to want to see that a client’s financial situation is being rigorously scrutinised in these meeting to ensure continued suitability of their current retirement plan. As well as keeping detailed meeting notes, it will be extremely useful to follow up in writing with confirmation of what was discussed, the decisions made and the reasoning behind this.

Lastly, any particularly high charging options need to be very well justified. As we have seen from the review firms of undertaking ‘second charge’ mortgage products, the FCA does little to actually understand what is being done in situations where higher charging is necessary.

From past experience we know that the FCA is not a great advocate of personal choice, believing that customers should be strongly advised to be cautious with their pensions, opting for guaranteed returns, no matter how poor the rates are.

This is in stark contrast to the ideals behind the “Pension Freedom” reforms in 2015. The FOS and FCA’s attitude to the increase in defined benefit pension transfers since 2015 appears to be a good example of how advisers can get caught out in the “no man’s land” between these two ideologies.

The government clearly recognises the need for the vast majority of people to take appropriate and cost-efficient advice when it comes to their pensions, as can be seen from the conclusions of the Work and Pensions Committee’s 2022 report on accessing pension savings[1], which recommends a host of changes to improve access to advice.

It remains to be seen how the FCA will define ‘appropriate’ in this context, but if BSPS is anything to go by, firms would do well to be prepared.

[1] https://committees.parliament.uk/publications/8514/documents/86189/default/

Written by Dan Kelly at Onyx and Alex Barry from Collegiate Management Services